Before we start: Please note that this is not investment advice and not a solicitation to buy or sell a cryptocurrency asset, coins or tokens. Since cryptocurrencies are a new asset class, references are made wherever possible. All statements are based on publicly available information and the author’s experiences. The author and The Coin Research have not received any payments from third parties to promote this article.

The blog will focus on Cryptocurrencies as we experience them in daily life. If you are interested to learn more about the blockchain technology behind cryptocurrencies, please refer to this Blockchain TED talk introduction video.

Like every beginning: When you first start with a completely new topic like cryptocurrency, you get overwhelmed. How to start and where to start? What keyword to search in Google? Where do you find helpful resources to learn more? This cryptocurrency learning guide is developed for beginners and it will take you max. 30 min to get through it. It will give you a solid first impression about what you can expect from the new world of cryptocurrencies.

Let’s just start the journey. Enjoy the learning experience. This journey might change your thinking about money, value transfer and potentially lead to a new future in your life.

Development of Cryptocurrencies

Cryptocurrency is still at a very early stage. However, among the millennials and with a huge distribution of computers and mobile phones, the technical knowledge of the population increases. This is driving the adoption of the crypto as a potential store of value. The concept of cryptocurrencies receives high acceptance among the younger population and has the potential to boom in the future. Crypto has been pushed by media along the all-time high from Bitcoin and Ethereum, two of the leading cryptocurrencies. News help to drive awareness and might turn skeptical people into “involved” who are slowly understanding the technology and thinking behind digital money.

Since this is a very young industry, market development is very volatile. Coming from a market capitalization of nearly not existent, it went over $500 billion and is at 119 billion at the time of writing. It’s impossible to estimate, where this will be in a year from now. However, over 3,000 different cryptocurrencies have been launched and around 2,000 are trading on the crypto exchanges.

Introduction into the Ecosystem Cryptocurrencies

In this article, we mentioned it already and you will have heard of Bitcoin and so-called “Altcoins”. Bitcoin is the legacy coin of the cryptocurrency ecosystem. It’s although not the first crypto coin, that has been invented. However, all the coins before Bitcoin failed because of technical challenges. Since the software and protocol of Bitcoin is Open Source, everyone can use this software to produce a new Bitcoin-like cryptocurrency. These new coins are called Altcoins (Alternative Coins). Whether the Altcoin is based on the Bitcoin blockchain or a completely different blockchain (like Ethereum) it falls under the same definition, to be an “alternative coin to Bitcoin”.

Splits of a blockchain, to create a new cryptocurrency, are called forks. The forks or clones of Bitcoin or a different blockchain aspire to serve different areas, aiming to be ‘better’ to address and solve a specific issue. Still, Bitcoin is leading the market capitalization in the crypto ecosystem and is by far the largest cryptocurrency. At the time of writing, Bitcoin dominates with 52.6%.

Cryptocurrency and Fiat

The money we use every day (like US-Dollar, Euro, Yen, etc) are called “Fiat” in the crypto communities. Fiat does not refer to the Italian carmaker, but to the official definition of the word in the English vocabulary (Fiat) and means “decree”, “edict”. Fiat money is a currency that has been established as money, often by government regulation. The Fiat currencies have been digitalized in the cryptocurrency space and they relate 1:1 to the formal official money.

Do not get puzzled with the concept of cryptocurrencies. Although cryptocurrency includes the word currency, when you purchase Bitcoin or Altcoins, you are in fact buying some participation on a blockchain project or company. You are not buying a currency in the traditional understanding. The value of a cryptocurrency can change significantly. The cryptocurrencies you buy are more comparable to a very high-risk stock participation, although they lack the qualities of a stock and the regulation and consumer protection behind it.

Cryptocurrency Exchanges

As mentioned, there are over 2,000 cryptocurrencies available and counting. Buying and selling of cryptocurrencies happen on specialized exchanges. These are different exchanges compared to the well-known stock exchanges, like Wall Street, NASDAQ. Crypto exchanges are websites where you may buy and sell your cryptocurrencies, using fiat money.

A short introduction into Cryptocurrency Exchanges

To start with: there are 2 types of crypto exchanges. Centralized exchanges and decentralized exchanges.

The difference is: in a centralized exchange, you deposit, trade and withdraw your cryptocurrencies with a centralized company, via a trading system. The centralized exchange factually “owns” your crypto, while its there. It’s fully under their control. This has become an issue several times in the young history of crypto. Exchanges can get hacked and you can lose your money. The famous Mt Gox hack is only one example, where 740,000 Bitcoin has been stolen. A staggering value of over $500 million.

In decentralized exchanges, you own your crypto. You transfer it to the blockchain, where your trade (buy, sell) will be listed and mined. The risk of losing your crypto is significantly lower and is in line with the risk of the specific blockchain to be hacked. However, decentralized exchanges are still very new and experimental in some cases. They have less liquidity compared to central exchanges and the user experience is not far developed yet.

There are several indicators to estimate the reliability and quality of a crypto exchange. Important is the availability of trading pairs, like Bitcoin to Fiat, Bitcoin to Ether, etc. Not all exchanges trade all available cryptocurrencies. Secondly, its the liquidity of the exchange, this means how much volume is the exchange trading in a specific pair. As the last point, you must consider pricing spreads, fees, limits to purchase and withdraw, security topics, insurance of your crypto, user-experience. Always have a look at the contact area of exchange. Very often they share no official contact address, are located in “legislation friendly” and “tax haven” countries, with zero regulation.

Best cryptocurrency exchanges for beginners

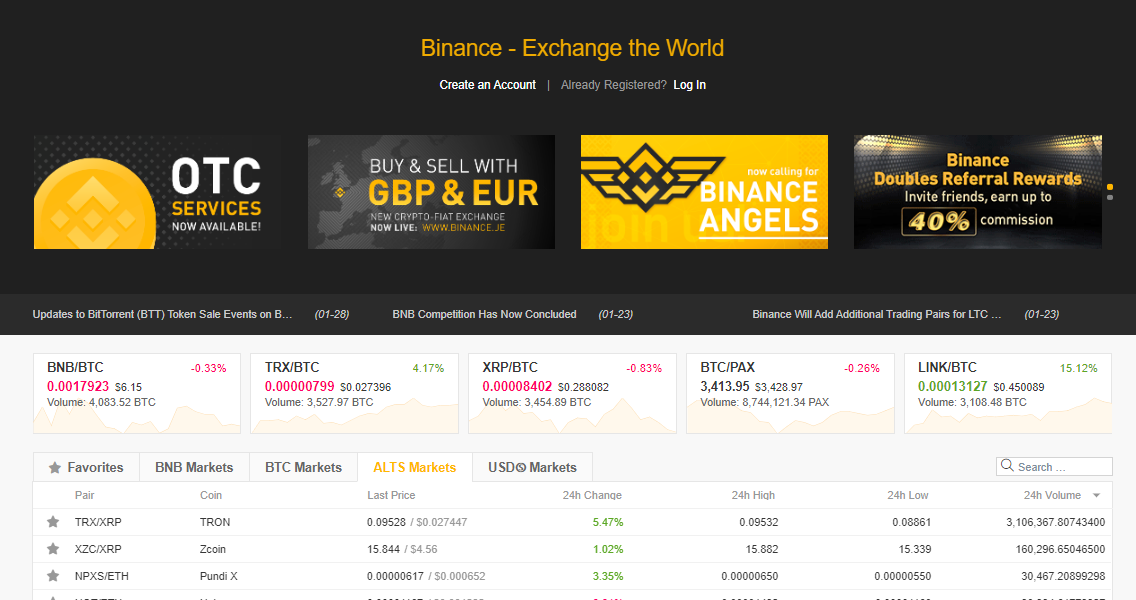

We recommend 2 crypto exchanges, that we find appealing for beginners. Coinbase and Binance.

By far the number 1 for newbies and best cryptocurrency exchange is Coinbase. It has a beginner-friendly user interface, very similar to your online banking or Paypal, and unbeatable insurance of your crypto deposits.

Number 2 on our list on crypto exchanges for beginners is Binance. Binance is more complex than Coinbase. It covers a significantly wider range of trading pairs and offers an advanced modus for passionate crypto traders. The user interface is a bit more complex and less intuitive, however, most beginners have no issue using it immediately.

The onboarding process is very similar to all exchanges. After setting up an intermediary exchange account, you will be required to go through a “Know Your Customer (KYC)” process to verify your details with Coinbase and Binance. You will need some more details for Coinbase, since they are a regulated exchange. Binance has fewer requirements and as well as less protection. Now after you finalized the KYC process, you are only six simple steps away from a Bitcoin or Altcoin purchase:

- Transfer Fiat money to the exchange (or use your credit card)

- Access the “Buy/Sell Bitcoin or Altcoin’ tab

- Select the payment method using the drop-down menu

- Enter the desired amount of cryptocurrency to buy or sell

- Click “Buy or Sell Instantly”

- View your credited or sold Altcoins on your dashboard

Now you own your first Bitcoin or Altcoin. You can trade different pairs, transfer it to other exchanges or to your hardware wallet. Note, however, that the transfer of crypto between different parties costs a small amount in cryptocurrency. Costs are far lower than real bank transfers, however, you need to monitor these. Transfers are not free and exchange might charge you a withdrawal fee.

Next steps in your “career as a crypto trader” could be that you onboard on other exchanges, like Bittrex or Bitmex. Bittrex is comparable to Binance, Bitmex, however, is a trading platform that semi-professional traders use. (Check it out and sign up with Bitmex)

When signing up on these exchanges for the first time, please consider that the verification process on these exchanges may take several hours or some days, and purchase/withdraw limits may only increase gradually as you trade.

An additional point for funding or withdrawals: the US Dollar is the most common Fiat currency used by exchanges. If you are using a currency other than US$, do check out the exchange’s funding and withdrawal policy. Note as well that some exchanges might have regional restrictions and e.g not serve US customers, due to applicable legislation.

Cryptocurrency Wallets

In the crypto ecosystem, your wallet is similar to your bank account in the real world. This is the place where you store your Bitcoin or Altcoins. All exchanges have inbuilt online wallets to receive, keep and withdraw cryptocurrency. However, as mentioned above, it is definitely not recommendable to store big quantities of crypto on exchanges, due to safety concerns and hacking risks. We recommend storing your crypto offline in a hardware wallet like Nano Ledger or in an online paper wallet like MyEtherWallet. Both serve the purpose of removing the exchange platform risk, at the cost and hassle of taking up the responsibility of keeping your cryptocurrency safe.

Our preferred offline hardware wallet is the Nano Ledger. A simple user interface, well documented and a good fit for most users.

To transfer your cryptocurrency from exchange to your hardware wallet, simply follow this very simple process, using Coinbase exchange and Nano Ledger as an example:

- Plug in your Nano Ledger USB cable

- Open your Ledger Live Software (a Software from Ledger to simply manage your crypto)

- Find your wallet address on the Nano Ledger Live Client by clicking on “Receive Crypto”. Software will show your receiving address.

- Access Coinbase ‘Send/Request’ tab and input your Nano Ledger wallet address

- Confirm the amount to transfer and click “Send Funds”

We always recommend testing the address and system working first. Therefore transfer only a small amount first to test it. In blockchain and cryptocurrencies, mistakes in the transfer process (e.g. wrong receiving address, sent Ethereum to a Bitcoin address) can lead to the loss of your crypto.

The Coin Research teams recommend using hardware wallets. Not only because you have a tangible item with your money, but mainly because it is safer, compared to “hot” online wallets. However, you have the risk of losing the wallet. Therefore it’s important to not your key and keeps it extremely safe. You can recover your crypto with the key if you lost your wallet.

This is not investment advice and we can not evaluate your personal situation. Please speak to a financial advisor, before you invest.

Generally speaking, cryptocurrency investments have the potential to realize many “get rich fast” stories, but the risks involved and the volatility makes it unpredictable. To be on the safe side: whatever you invest in crypto, you should be prepared for losing it. Emergency funds, pension funds, retirement reserves should never be invested in cryptocurrencies. The upside to gain is huge, but it comes with lots of risks and may put you under emotional stress. The emotional pressure and stress to lose 20% per day is something you should consider before you jump in this adventure.

For a conservative investment portfolio, we would suggest the following:

- People below 25 years, not married, no kids: maximum 20% in cryptocurrencies and 60% in traditional stock investments, 20% in cash (depending on investment cycle this could be higher or lower)

- If you are between 25 – 50 years old, married an maybe with kids, maximum should be 10% in crypto and 60% traditional investments, cash 30%.

- Over 50 years old, you should hold a maximum 5% in crypto, and 75% in traditional stock investments, funds or similar.

This rough calculation considers the different live phases people are generally in. It reflects the financial responsibility or burden one might have and the risk associated with investment in crypto. It is definitely not a clever idea, to maneuver yourself into a paycheck by paycheck life and to risk the funds acquired to und your house, kids college or retirement.

How to identify the right crypto investment opportunity? What crypto coin should I buy?

There are several approaches to identify cryptocurrency investment opportunities. these are two types of analysis that investors generally do. Technical Analysis and Fundamental Analysis. Most of the high-frequency traders and day-traders we know are good at technical analysis and most of the investors look more into the Fundamental Analysis. Best investors usually do a mix of both. They use the fundamental analysis to understand the basics of a project and the technical analysis to decide the purchase point/price point.

What is Fundamental Analysis for a cryptocurrency coin?

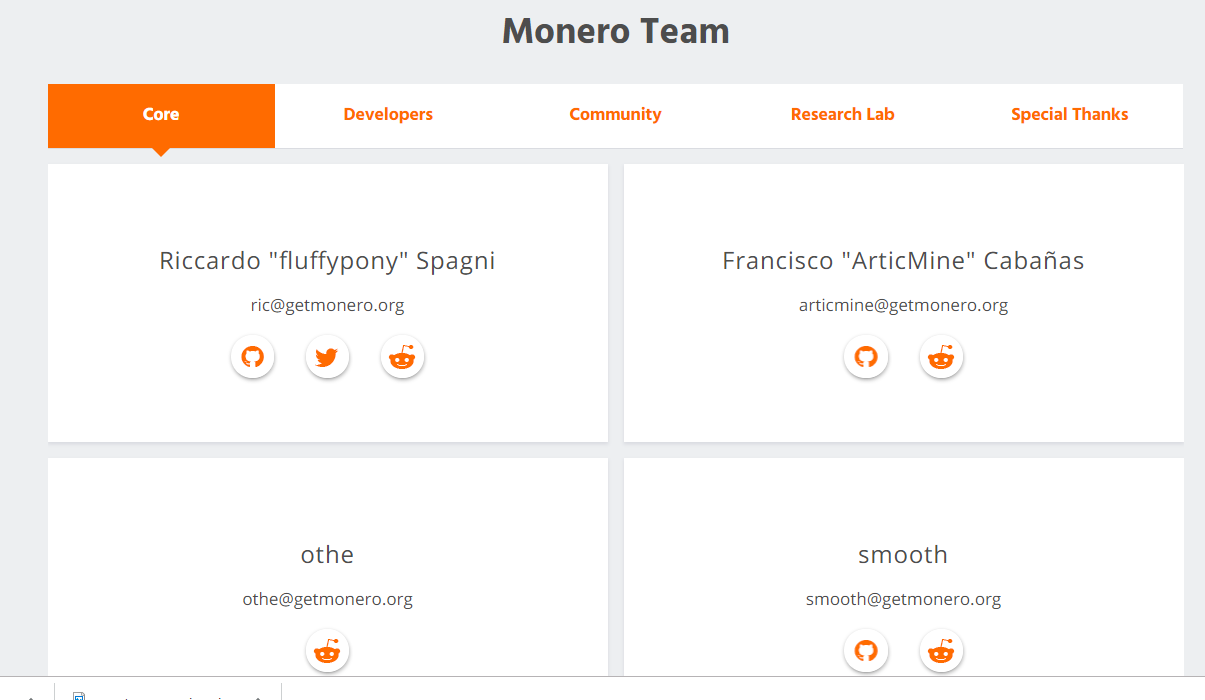

Fundamental analysis is the study of the fundamentals of a project that you are investing in. It involves intensive researching about the project, the company, the team behind the company, their previous achievement, the business area they are working in, the real world problem the project is trying to solve, the roadmap and commitment to it, the financial abilities, the development team, the technical struggles, and much more. The research form The Coin Research Team is mainly focused on Fundamental Analysis.

What is Technical Analysis for a cryptocurrency coin?

Technical Analysis is the art of reading charts. Basics are to read a pattern in the charts, trade on a pattern and hope that the price development follows your estimated pattern. It is founded on the principle that price action tends to repeat itself due to the collective, patterned behavior of investors.

Sounds complicated? It is!

This is why The Team Research offers a set of researched reports for cryptocurrency investors. We analyze the fundamentals of projects based on the proprietary Cryptocurrency Valuation Modell from The Coin Research. Based on these we can estimate developments of crypto coins and make researched and founded recommendations.

In addition, the coin Research offers a comprehensive Risk Management guideline for every coin, to address the volatility and reduce losses to planned and calculated levels.

How to get more Crypto? Trading and Investing in Cryptocurrency

You might have your first Bitcoin and want more. There are several ways to get more crypto. Trading, Mining, Stacking are a few of them.

Trading and investments in cryptocurrencies are quite simple. Once you understand the basics of the crypto world, it’s as simple as buying stocks and trading options or other investment instruments.

Short Term Crypto Trading with Margin

For the experienced stocks and forex traders, the trading with margin on crypto is not new at all. Crypto trading with margin follows similar principles. For the new crypto investor, however, this requires a bit of learning and a short brief up on how to make a margin / leveraged trade.

It goes without saying, that short-term trading takes advantages of incoming news or trend development to make some quick money. If you foresee the development of a coin based on maybe some good news or announcements, you could open a long leveraged trade and see how it goes. Like in the real world: you have to be fast and buy the rumor, sell the news. Take the profit, once you have it and be very disciplined with your trading strategy if you wish to make a profit with short term margin trading.

Mining of cryptocurrency coins

If trading is not your world and you like more the computers and software, mining could be the way to earn some crypto. However, due to very high difficulty levels for most blockchains, you might need high tech equipment to be competitive. Mining involves setting up a rig of computers, consisting of Graphics processing units or Computer processing units and quite high investment in the electricity. Mining with a regular PC or Laptop is technically possible, but for most blockchains not worthwhile. The computation power of a standard computer is far to low and electricity costs will be higher compared to the crypto-coin rewards you will get for Proof of Work Mining.

Staking of Cryptocurrency to earn more coins

For Proof of Stake blockchains, the staking is the comparable version of “mining. As a matter of fact, it’s not mining at all, as it requires no mining equipment. You get a reward for staking your coins and participating in a governance model of the blockchain. Very similar to the dividends you might get for holding a stock. The reward rate and staking method differ greatly among Proof of Stake coins, but in general, it takes less effort as compared to mining.

Further Helpful Resources for Beginners in Cryptocurrencies

The best place to check your coins value is Coinmarketcap.com You will find the actual price of your coins at different cryptocurrency exchanges. As well as links to project details, community, twitter handles, etc. A good source of information is the coins’ subreddits for news and market sentiments.

The Coin Research Team wishes you success and researched investing. Do your own diligence before you invest or check the reports in our member’s area.