Introduction Binance Token (BNB)

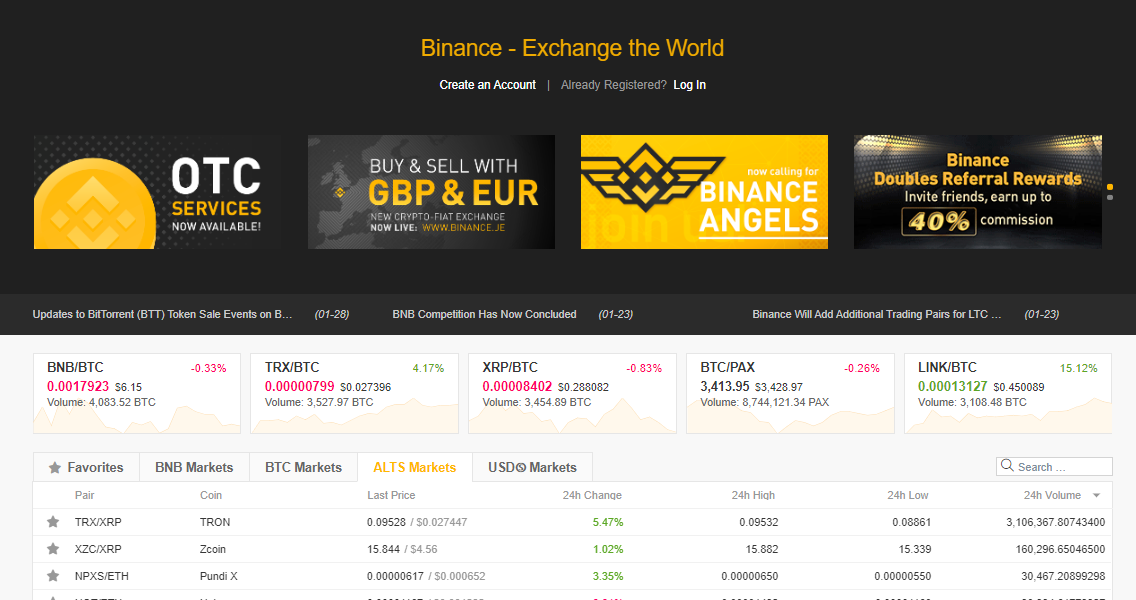

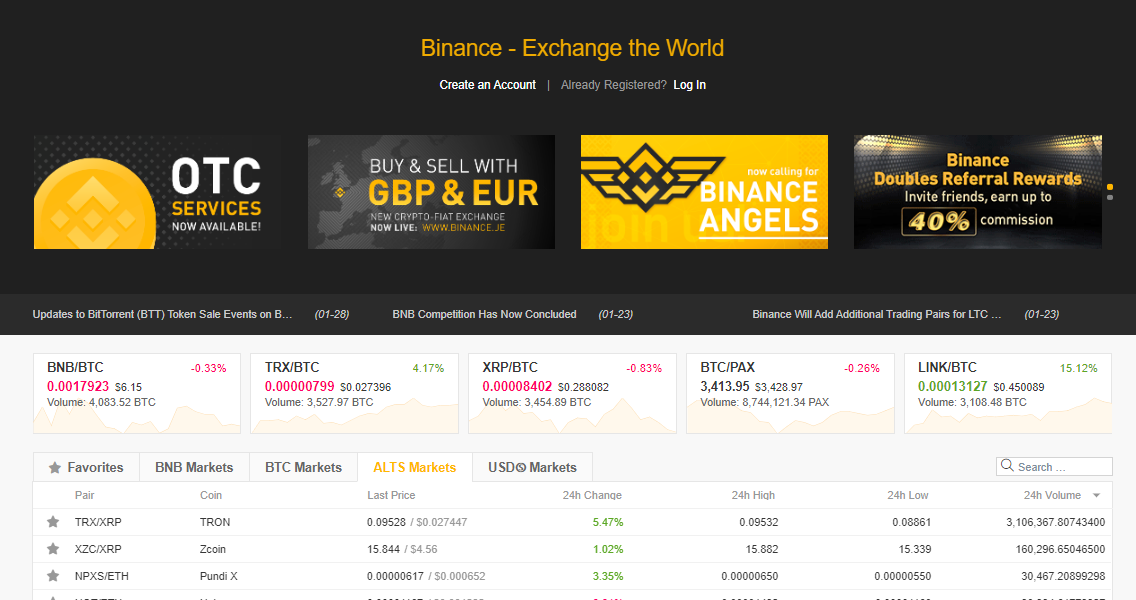

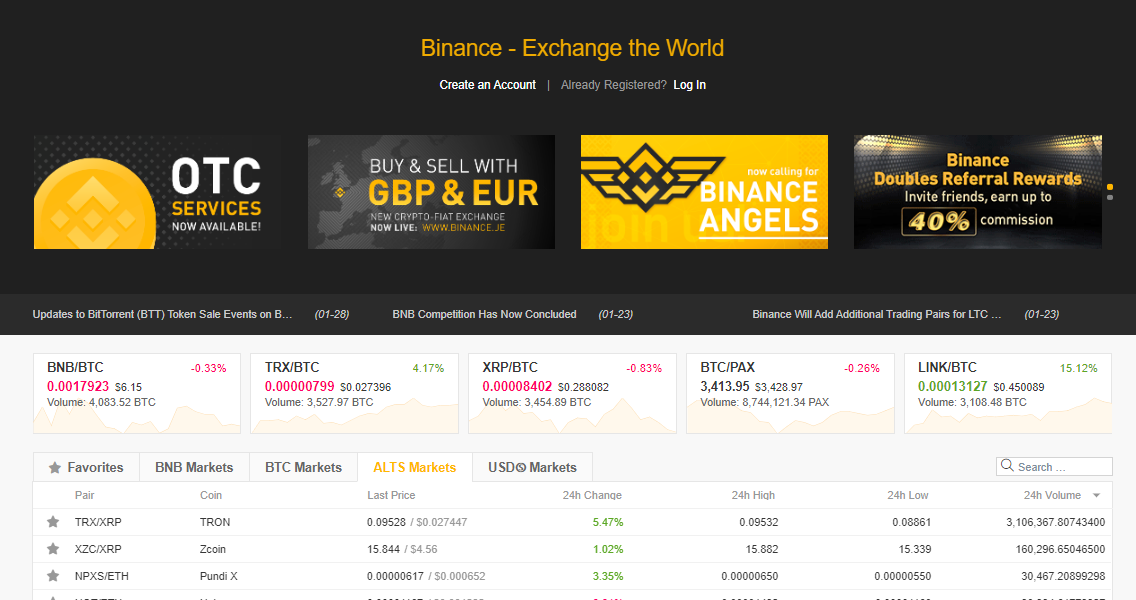

Binance Exchange is by far the no. 1 cryptocurrency exchange worldwide that offers to trade in more than 50 crypto coins including the leading pairs of Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH) and of course Binance Coin (BNB). The name of the exchange Binance is based on a combination of “Binary and Finance”. Its based in Tokyo, Japan and has been launched during summer 2017.

Binance BNB token is the use token of the Binance exchange. BNB is an ECR 20 token based on the Ethereum Blockchain protocol. The BNB token has quickly gained popularity and high trade volumes, trading at the time of writing around a market cap of around $800m (no. 12 on Coinmarketcap). The onboarding of new users is standard for exchanges. Users have to complete the Know Your Customer (KYC) forms. Upon successful account creation, users can add crypto funds to the wallet address provided by Binance to start trading.

In addition to the exchange, Binance has a blockchain startup incubator called Binance Labs, which focuses on the development of promising early-stage projects. It helps highly selected cryptocurrency project teams by providing necessary funding for development, management, and advisory resources, and a launch pad for financing or fundraising exercises.

BINANCE (BNB) CRYPTOCURRENCY EXCHANGE - EXCHANGE THE WORLD

Cryptocurrency Investment Report

The Investment Story for Binance Exchange Token (BNB)

Binance (BNB) Token is a Top 12 Coin at Coinmarketcap at the time of writing.

Binance (BNB) is the next Amazon on the rise. Some compared Binance with Google. This is wrong. Google offers services to the consumers, however, makes the profit in a B2B model, as an intermediate for the advertising industry. They sell the data (profiles, demographics, etc) of their customers to the advertising industry.

Amazon offers a product to the consumer and physically sells/delivers value to the consumer. Big difference to Google. Amazon deals with the consumer directly and is working hard to offer the best service, best user experience. The direct contact and direct execution of the sale, the roll-out country by country, the trust required from the masses, that’s what makes the difference.

Binance has very good chances to become the next Amazon!

Why? Simply because their retail product is awesome fast, trustworthy, have a lot of open communication, offer the relevant products (pairs of trading), zero hassle approach. Good customer service, that cares about the customer itself, a respected, open and charming CEO, open communication to the communities.

The biggest weakness of Binance? They are a centralized organization. And like every centralized company, it can be seized, governments can take over control of the exchange, software, funds in wallets, etc. And of course, your funds are always under risk, if you deposit them in a central exchange. If you don’t control your keys, you don’t control your crypto. Binance, however, has implemented a #SAFU funds, to deal with emergencies, where customers lose their money.

Binance (BNB): Probably the strongest investment story on cryptocurrency

The development of Binance as an exchange platform is dependent on the cryptocurrency market development. High volatility generally speaking is good for Binance, because it means high volume trading. When Bitcoin jumped towards $20,000 in December 2017, Binance made record profits. The trading of retail investors, smaller institutions and whales led to record quarterly EBIT results.

This has calmed down during 2018. Sales pressure and low buy volumes take a toll of Binance profits. Not to forget: the collapse of the ICO market, losses on Altcoins or Shitcoins over 90%, have a negative impact on the investor’s sentiment. Still, Binance trades between $500 – 700 million per day.

Extremes are always temporary events. The cryptocurrency market will soon balance out and find its midpoint, where sales and buy orders level out. Those investors with the guts to buy when blood is on the street, will be rewarded just like the people who sold in times of euphoria.

Not everyone is going to survive this carnage. Some exchanges will have to give up, Liqui.io is just one of them. One company that is definitely going to survive and is prospering during the bear market is Binance (BNB). The token has significantly outperformed other cryptocurrencies during this bear market. Binance lost as well in value, compared to the peak performance, however, the recovery after the bottoming out, looks very promising and strong for me.

There is a saying, the bank always wins. During a recession or boom periods, the bank always earns a solid profit on the services provided. Same applies for Binance. Be it a bull or bear market, the exchange always profits from trading fees. The trading fees might be higher during bull periods of course. So are the costs, like more customer service, support, IT, data, servers, etc… Therefore an exchange will, of course, adjust the cost basis during a bear market to manage the level of profitability, For sure, at the moment, there are only very few more lucrative businesses in blockchain than Binance.

Binance has the realistic chance to dominate the cryptocurrency exchanges in future and become an Amazon for blockchain. A strong exchange business, the development of a decentralized exchange on top, Binance lab as an incubator for blockchain projects are the key arguments that support this bet.

Investment Rating for Binance Token BNB

Time of writing: 29/01/2019

BUY

Short to mid-term buy in the range of:

5.50 – 8.50 USD

Investment Valuation Scores for Binance Token BNB

The Valuation Scores are based on the Cryptocurrency Valuation Model developed by The Coin Research Team. Please see below for more details.

Cryptocurrency Investment Strategy for Binance (BNB) Token

Investment Rating: Buy Binance Token (BNB)

Buy Up to Price / Accumulate: $5.50 – $8.50

Stop Loss: $4.80

Position Size: $500–1,000 if you’re a smaller investor or $1,000–2,000 if you’re a bigger investor

Time of writing 29/01/2019

Cryptocurrency Exchanges: Where to buy Binance (BNB) Token?

Best Exchanges to buy Binance Token (BNB):

At the time of writing, BNB is being traded in 106 cryptocurrency pairs on key exchanges. The Exchanges with the biggest volume is Binance.

Buy It On: Binance (RECOMMENDED)

How to store Binance Tokens (BNB)?

BNB Tokens are ECR20 tokens, stored on the Ethereum blockchain. Every cryptocurrency wallet that works for Ethereum, will work for BNB too.

We recommend to not store the coins on cryptocurrency exchanges. It’s safer to use the own wallet, where you control the keys.

Store It On: Nano Ledger (RECOMMENDED), MyEtherWallet

Price Scenarios and assumptions for Binance Token (BNB)

Bull Case Scenario:

Target price range 15.10 – 22.00 USD

(Assumes recovery of the cryptocurrency market)

Base Scenario:

Target price range 9.25 – 10.30 USD

(Assumes that the market turns around and no significant negative impact from launches of competitive exchanges)

Risk Bear Scenario / Stop Loss Scenario:

Target price range 4,80 USD (-23%)

(Assumes continuing bear market, competitors offer a better protocol)

You have not selected any currency to display

Time Horizon for Binance Token (BNB)

Our target prices are based on mid-term to long-term scenario estimates.

Note that the current market development and the chart development of BNB do not indicate a turnaround from the downward trend. Cautious investors should wait for turnaround signs of the market and BNB.

Out mid-term definition means 6-12 month, long-term 12-18 month.

Short-term investments (less than 3-4 month) are the playground of traders, day traders, who are “always online” to monitor the live market’s developments based on Technical Analysis and Fundamentals.

Chart Development of Binance Token (BNB)

Key research findings: Binance Coin (BNB)

Part 1): Company Background and Recent Updates of Binance Token (BNB)

Binance has been founded in during Summer 2017 by Mr. Changpeng Zhao, well known among the Twitter community as @CZ_binance. At the point of launching, Binance provided very compelling reasons for investors and traders to use the platform:

- fast order execution

- transparent order book

- broad pairs of cryptocurrency pairs

- high liquidity

- simple onboarding process

- straightforward UX

In addition to this Binance somehow managed to stay away from the bad press, e.g Pump & Dumps, hacks, fake ICOs, etc. Today Binance can transact over 1.4 million transactions per second (according to their website). That’s probably record-breaking among the crypto exchanges. Binance managed to increase very quickly the user base, estimated to be around 10.000.000 by end of 2018 and developing very fast.

And Binance continues in the race of dominating the cryptocurrency trading. Or as CZ said during a conference in Singapore: „Fiat is still where all the money is in. … And we’ve got to open that gate“. They plan to open 5-10 crypto exchanges during 2019.

In addition, CZ from Binance launched a venture called Binance Labs in September 2018. This is an Incubator program for Blockchain projects with the aim to bootstrap cryptocurrency start-ups of all kinds. Similar to what the Silicon Valley corporations have been doing over the last 20 years. They acquired various companies with interesting products to absorb their solutions. Binance goes the route of early-stage Venture Capitalists by funding start-ups in-house. More than 500 applications were sent to Binance in the first season of the Incubator program. From that number, Binance chose only eight teams they will support.

The use cases of Binance Token BNB

The blockchain is still a very young industry and in today’s landscape, a lot of cryptocurrencies exist as token bets on services that have yet to translate to actual use cases and products. Only few Cryptocurrency Coins have a clear use case linked to the blockchain, like Bitcoin (store of value), Ether (powering transactions and smart contracts), Monero (privacy coin).

With the Binance (BNB) token you can:

Pay for the exchange fees on Binance for your cryptocurrency trading orders. The use of BNB to pay for transaction fees give users at the beginning a 50% discount compared with the prevailing rate for other cryptocurrencies. That discount has changed to 25% recently, as stated in the Binance whitepaper, but it’s still a great deal for the cryptocurrency traders.

Pay with BNB for services or goods across many websites.

Binance managed to convince some first adopters to implement payments with BNB. They have a clear focus to increase the network of merchants and establishments that accept BNB. We expect use cases to grow further, as they support more blockchain innovators via Binance Labs and Binance Launchpad.

On CryptocurrencyInvestment.org you can pay the Membership fee with Cryptocurrencies (including BNB) too.

And until further use cases are developed, Binance has an ongoing commitment to decrease the total supply of BNB in the market. Every quarter since it launched, Binance committed to using 20% of the profit to buy back Binance Tokens and burn them permanently.

Twitter Feed Binance Token (BNB)

Part 2): The Team and the Investors of Binance (BNB)

The Binance team is comprised of members from a wide variety of backgrounds and experiences including blockchain engineering, investment banking, strategy consulting, academic research, and data science. CEO is as mentioned Mr. Changpeng Zhao. On LinkedIn we found 673 employees worldwide.

This is most probably one of the largest teams in cryptocurrency.

Part 3): Valuation of Binance Coin (BNB)

Like always the introductory reminder: Cryptocurrencies are a new asset class. The performance of these assets is based on a different set of fundamentals, compared to standard Stock or Bond assets. Most projects are in an early stage, very much comparable to startups during the Dot.com area. Therefore financial indicators (like Net Revenue, Margin, EBITDA, Cash Flow) would not provide valuable insights and are not available. Softer Key performance indicators are rarely available too, like the number of customers, adoption rate, etc.

The Coin Research Team has developed a comprehensive CRYPTOCURRENCY VALUATION MODEL for Tokens and Crypto projects. We use a broad set of indicators and group them into 3 categories:

- Project Fundamentals

- Token Economics

- Community / Social attention

The Score range is from 0 – 100 (maximum).

Scores above 70 indicate very solid projects with strong indicators in the subsegments researched.

Project Fundamentals Score

Token Economics Score

Community / Social Attention Score

The Coin Research Valuation Model for Cryptocurrencies considers the following:

- Fundamentals Score: Research of the Idea, Use Case, Whitepaper, Blockchain, Legal risk ICO, Funding level, Competitive situation, Roadmap, Github, Team, Leadership, Governance, Investors, Advisors, Transparency, Communication, and several others.

- Token Economics Score: Token use case, Value from the use case, Incentive to use it, Inflation, Distribution, Decentralization of Ownership, Dividend Model, Governance model, Exchanges, Liquidity, Daily Volumes, Fluctuations, and many more.

- Community and Social Attention Score: Followers, Hashtags, Mentions, Members Social Media channels, activity, quantity and quality, Tonality, Promotions, Educational material, Support Groups, etc.

Part 4): Investment Risks for Binance Coin (BNB) and How to Mitigate Them?

The invest concept of a cryptocurrency is still novel and, compared to traditional investments, Binance Token doesn’t have much of a long-term track record or history of credibility to back it. With their increasing use, Cryptocurrency Coins and Tokens are becoming less experimental every day, but remain in a development phase and extremely volatile.

Please note and unchanged: Cryptocurrencies are pretty much the highest-risk, highest-return investment that you can possibly make.

Our overall risk evaluation is LOW for Binance (BNB).

Risk 1: Market Volatility for Binance Token

Cryptocurrencies and BNB included, are highly volatile assets. The 2-3% fluctuation you might know from the stock market, can easily translate to 8-12% fluctuation in Cryptocurrencies. During the same day!

Indeed, the value of the BNB Token has seen wild swings in price over its short existence.

The volatility of BNB Token fluctuates between 2.00 USD to 22.00 USD. Larger swings on a daily basis between 2-5% are rather usual than exceptional.

We see the Binance BNB cryptocurrency coin currently in a side-trend, consolidating around 5.80-6.50.

Source: Coinmarketcap

Risk 2: Company Inherent Risks for Binance BNB

Company inherent risks are:

- Security breaches and hacks of the Binance exchange. Note this is a “Software Only” company and the software/ protocol is everything they produce. Entirely digital companies and all cryptocurrencies face a high risk from hackers, malware, and operational glitches.

- Important team members could leave the project. The best ideas are worth nothing if there are no high skilled people to execute. The expertise of the leadership team and especially of the CEO CZ_Binance at BNB is crucial for success.

- Decentralized exchanges could win over trading volume from Binance over time if Binance can not offer an adequate decentralized offer.

The BNB Token price is quite dependent on the total market situation and the development of the cryptocurrency / blockchain industry. Negative developments in the industry, e,g, on Bitcoin, Ethereum and other main Cryptocurrencies will affect the price development of BNB.

Risk 3: Regulatory Risk for Binance BNB Token

BAT raised money through an ICO (Initial Coin Offering) (15m USD, Summer 2017). As a result, governments may conclude that BNB tokens are securities and might seek to regulate, restrict or ban the use and sale of tokens. Or the SEC might enter into a legal dispute with Binance.

Risk 4: Investors Risk Binance BNB Token – Consumer Protection

Unlike traditional banks, cryptocurrency doesn’t have any official safeguards or insurances. Your wallet is not a bank! Your exchange is not a bank!

For example, whereas the Federal Deposit Insurance Corporation underwrites depositors’ savings to the value of $250,000 each in both banks and brokerages, crypto exchanges are not part of the program. If your exchange becomes insolvent, you will lose everything.

Ultimately, buying cryptocurrencies could result in losing everything you invested in them. You should never invest more than you can afford to lose.

Part 4): The Worst Case Scenario and How to Avoid it?

The worst-case scenario for Binance BNB is that the coin falls to zero. Or nearly zero. This can happen if the Software would be hacked, the issue is not solvable and the company would not be viable. However, the probability is extremely low for this.

Form an investors point of view, the risk is that the investment does not develop positively and the coin drops in value.

How to avoid losses with cryptocurrencies?

We recommend working with a clear Loss limit Strategy. Means, when the coin reaches a level you set, e.g. 4.80 USD for BNB, you sell the investment.

This can be executed via Stop Loss Orders if you keep the coins in exchange. Stop Loss Orders allow you to set a price at which you want to sell a coin. Stop-loss orders are designed to limit an investor’s loss on a position in a security.

Example: if the coin reaches 4.80 USD, your Stop Loss Order will be executed and you would automatically sell at 4.80 USD. Note that if the price of the coin never reaches your limit price, your trade won’t be executed.

Stay tuned to The Coin Research and check our updates of the Binance cryptocurrency investment report. We will publish updates to Binance BNB on a regular basis.

Disclosures:

The Authors do own small quantities of BNB tokens for trading on Binance. This research report is strictly informational and is not investment advice. Please refer to our Legal Notices for further information. The Coin Research and the author did not receive compensation to create this research report, outside of our customers and subscription paying members. We have not been hired by the covered company or other third parties (e.g. consultants, advisors, VC) to prepare this research report.

Forward-Looking Statements and Projections:

Any estimates, projections, forecasts included in this document are speculative and based upon analysis of publicly available information. The targets, recommendations, thoughts shared in the report are subject to known and unknown risks, uncertainties and other unpredictable factors. The report might not cover all risks, might be materially wrong and forecasts might not materialize. No representations or warranties are made as to the accuracy of such forward-looking statements.